The S&P 500 Index Approaches All-time High

Communication Services Sector has been the best performer last week

Stocks performed well this week, resulting in the longest winning streak since 2017. Investors are becoming more optimistic about the economy's ability to avoid a recession shortly. The S&P 500 Index has approached its all-time intraday high by 84 basis points since early 2022, while the Nasdaq 100 Index and Dow Jones Industrial Average have set new records.

The S&P 500's rise is mainly driven by the Communication Services sector, led by gains in Alphabet-GOOGL and META. Meanwhile, energy shares have benefited from rising oil prices due to concerns about Red Sea shipping attacks.

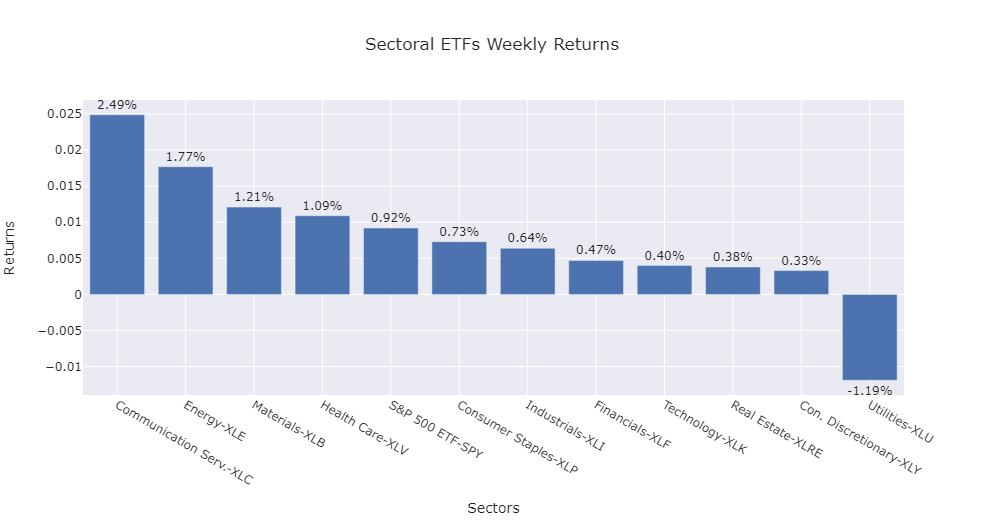

Weekly Returns

Last week, the S&P 500 ETF-SPY gained 0.92%. Four sectors beat SPY: Communications-XLC (2.49%), Energy-XLE (1.77%), Materials-XLB (1.21%), and Health Care-XLV (1.09%). The only loser last week was Utilities-XLU, with a 1.19% decrease.

Year-to-Date Performances

Technology-XLK has led year-to-date performances with a 55.31% return. Communications-XLC and Consumer Discretionary-XLY have followed XLK with 45.41% and 37.07% returns respectively. These are the only three sectors that beat SPY (23.90%). Utilities-XLU has been the loser of the year with -8.86% return. Consumer Staples-XLP (-3.53%) is the other sector with negative returns.

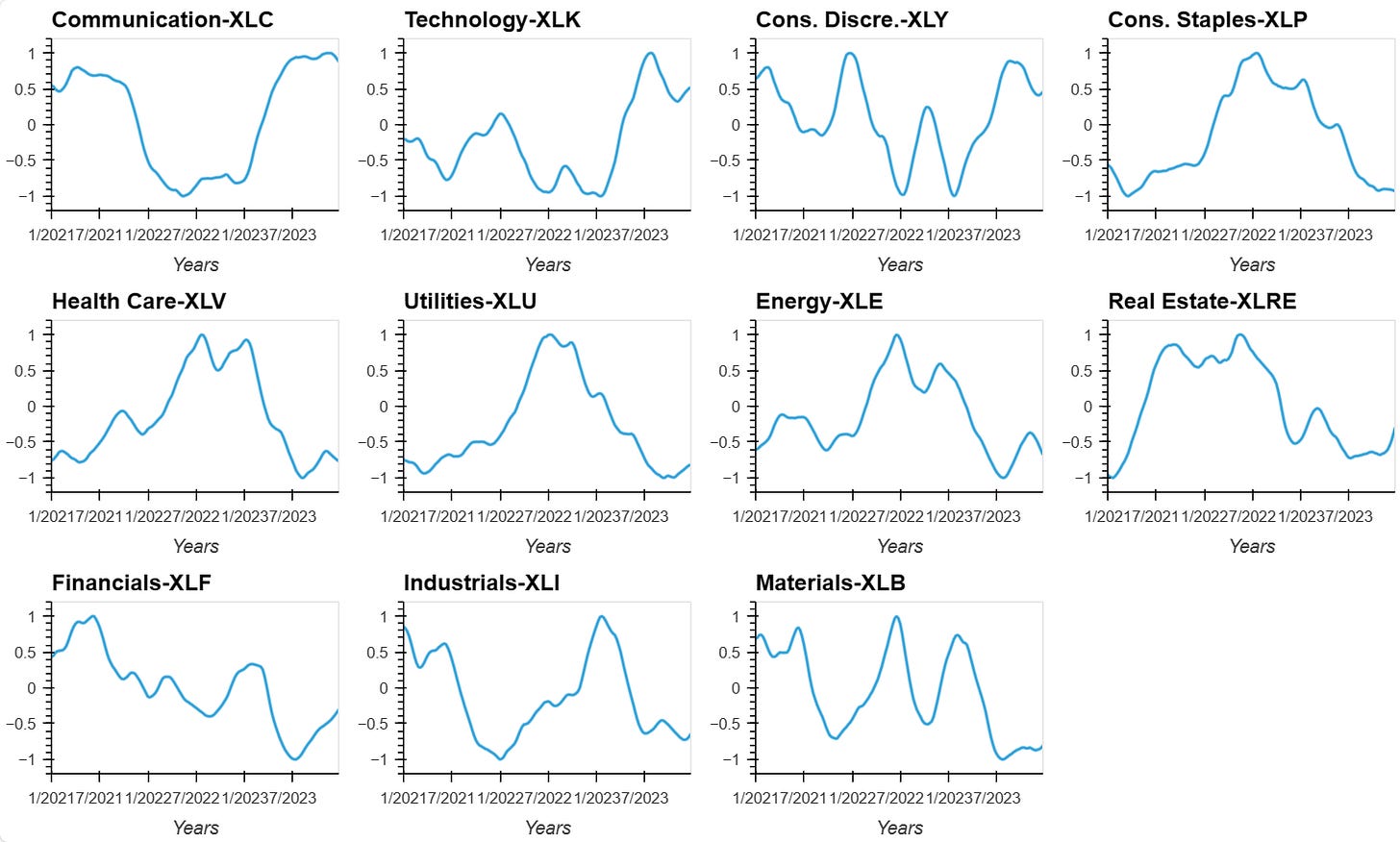

Sectoral ETF Cycles

Although Communication-XLC was the best performer in weekly returns last week, its relative strength (to SPY ETF) can be seen in Figure 3. While XLC’s line chart turns its face down, Real Estate-XLRE and Financials-XLF look up, indicating they gain strength relative to SPY.

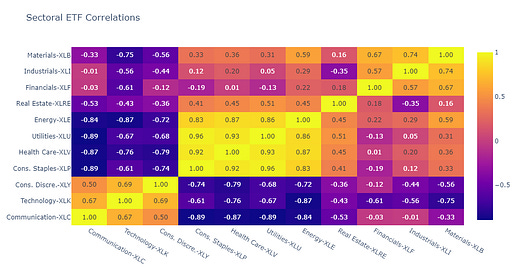

The correlation value between Financials-XLF and Industrials-XLI has been at 0.57 from 01 January 2021 to 22 December 2023. This might mean that an increase in XLF may bring together an increase in XLI, Table 2.

Communication Services Sector ETF (XLC)

It was a good week for Communication-XLC. Four of its major holdings have closed the week outperforming XLC; these are Alphabet_A-GOOGL (6.70%), Alphabet_C-GOOG (6.63%), META (5.51%), and Netflix-NFLX (3.11%). Comcast-CMSA and T-Mobile-TMUS have been the only ones with negative returns -1.08% and -0.28% respectively.

Comcast-CMSA trades ($44.00) significantly below its fair value ($76.07), hinting at substantial growth potential. With a predicted annual earnings growth of 3.35% and a staggering 180.4% surge in recent earnings, it showcases strong financial performance. Additionally, a reliable 2.64% dividend yield provides an appealing income stream. Its favorable valuation compared to peers and the industry suggests promising prospects for investors seeking undervalued assets with growth potential.

Technology Sector ETF (XLK)

Three stocks gained more than 2% last week: Accenture-ACN (2.99%), Oracle-ORCL (2.79%), and Adobe-ADBE (2.41%).

Salesforce-CRM had a return of 1.81% last week. SimplyWallStreet predicts a fair value of $354.08 for CRM, 24.8% above the current price ($266.34). Besides, forecasts indicate a robust annual earnings growth rate of 27.63%, showcasing a promising trajectory for future profitability. Impressively, its earnings surged by an extraordinary 832.4% over the past year, indicating exceptional and rapid financial expansion. Collectively, these indicators suggest a compelling investment prospect with substantial room for growth and a positive outlook for potential investors.

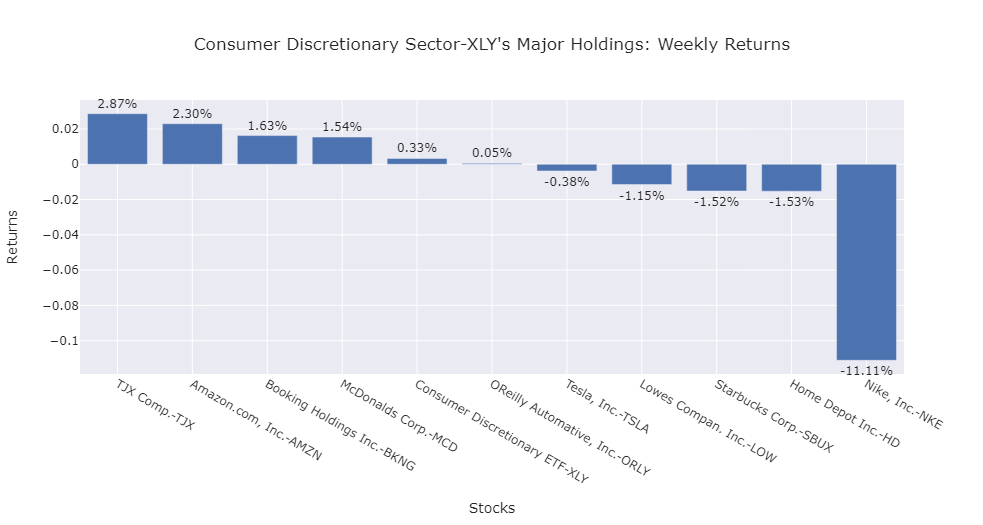

Consumer Discretionary Sector ETF (XLY)

The last week’s biggest surprise was NIKE’s 11.11% loss. The decline in sales follows the company's announcement that it anticipates a decrease in sales for the rest of its fiscal year ending in May. According to the SimplyWallStreet, the stock is currently overvalued by 50.0%.

Consumer Staples Sector ETF (XLP)

Three sectors have beaten Consumer Staples ETF-XLP last week. These were Walmart-WMT (2.56%), Costco-COST (1.94) and Procter & Gamble-PG (0.92%).

On the contrary, Coca-Cola-KO decreased by 0.48 last week. However, its fair value is predicted to be $75.99, 23.3% above its current price of $53.32. The company demonstrates consistent annual earnings growth, with a forecast of 6.18% and a historic 11% increase over five years, along with a reliable dividend yield of 3.16%, making it an appealing choice for investors seeking stability and potential growth in the market. It presents a well-rounded opportunity with consistent earnings growth and dependable dividends.

Health Care Sector ETF (XLV)

Last week, Pfizer-PFE, which has been experiencing a downtrend for almost a year, had a 6.65% return. The SimplyWallStreet forecasts a fair value of $96.90 for PFE, which accounts for a nearly 71% upside, considering its current price is $28.40.

On the other hand, United Health-UNH had a 2.04% loss last week. The fair value for UNH is $892.21, which is 41.7% above the current price of $520.31.

Utilities Sector ETF (XLU)

Utilities-XLU had a bad week, with a 1.19% decrease last week. Many of its major holdings had significant losses, such as Dominion-D (-3.47%), Constellation-CEG (-2.88%), and Nextra-NEE (-2.88%).

Constellation-CEG is trading at $115.33, 50.8% below its fair value of $234.41. However, some risks are associated with investing in this company from a fundamental financial point of view. The investment is expected to experience a worrisome 0.3% yearly earnings decline over the next three years. Additionally, there is a heavy reliance on non-cash earnings and a high debt level not supported by operating cash flow.

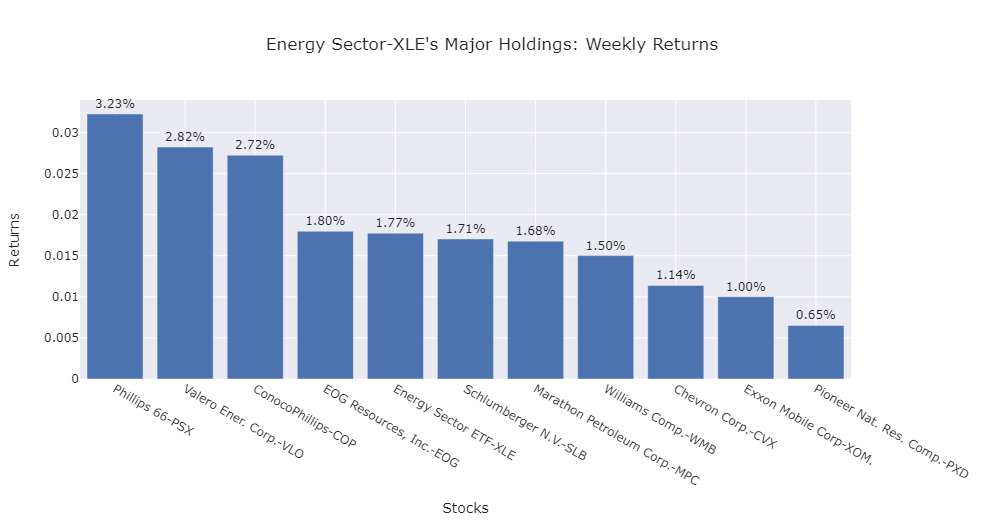

Energy Sector ETF (XLE)

Energy-XLE had a good week with a 1.77% return last week. Three of its major holdings had returns larger than 2.5%. These are Philips 66-PSx (3.23%), Valero-VLO, and Conoco Philips-COP (2.72%).

EOG Resources-EOG had a potential for going upside by 25.9% as it is being traded at $122.27, below its fair value of $165.07.

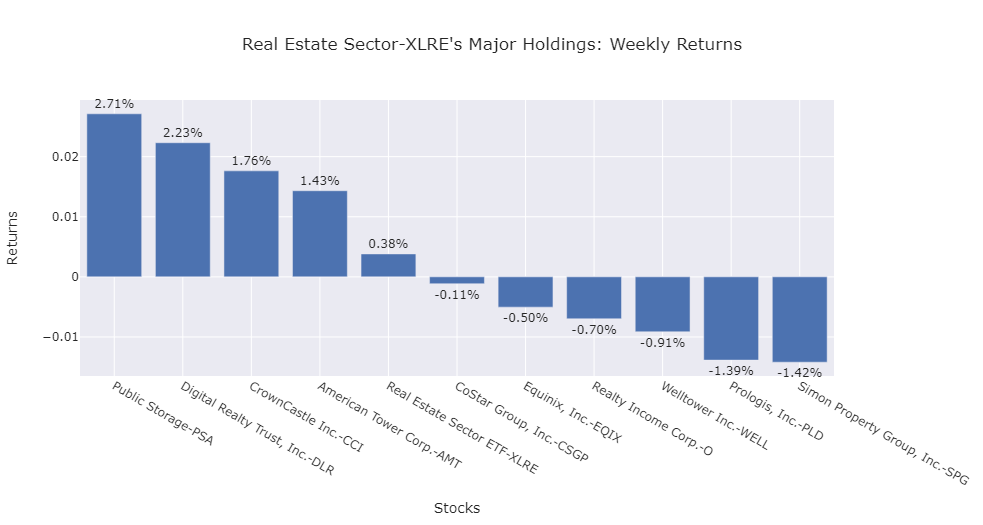

Real Estate Sector ETF (XLRE)

Public Storage-PSA has been the best performer among major Real Estate-XLRE stocks with a 2.71% return. PSA is currently being traded at $297.93 below its fair value ($438.32) by 32%.

Financials Sector ETF (XLF)

Wells Fargo-WFC was the biggest loser last week, with a 2.25% loss. However, there would be a long-term investing possibility, considering WFC is traded at $49.18, below fair value ($75.09) by 34.5%.

Industrials Sector ETF (XLI)

Although Industrials ETF-XLI finished the week with 0.64%, three stocks gained more than 2.5% last week: RTX (3.67%), General Electric-GE (2.81%), and Deere & Company-DE (2.78%).

The losers of last week were United Parcel Service-UPS (-2.88%), Boeing-BA (-1.45%), and Automatic Data Processing-ADP (-1.35%).

ADP has been trading 34.3% below SimplyWallStreet’s estimates.

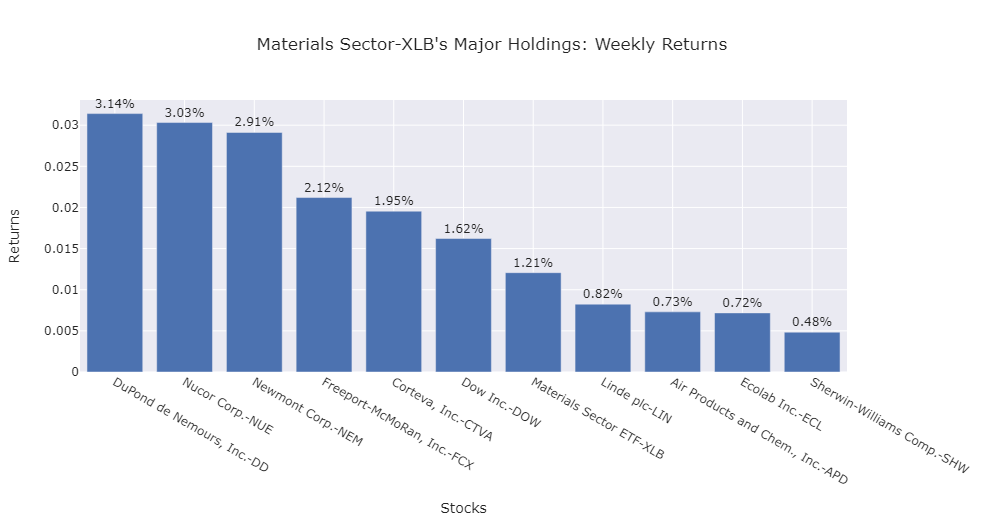

Materials Sector ETF (XLB)

Three stocks gained more than 2.5% last week among Materials-XLB’s major holdings: DuPond-DD (3.14%), Nucor-NUE (3.03%) and Newmont-NEM (2.91%).

According to the SimplyWallStreet, Air Products and Chemicals-APD is currently traded (at $272.84), 41.0% below its fair value ($462.77). Despite a modest 2.2% growth in earnings over the past year, APD forecasts a substantial 13.95% annual growth rate, signaling potential for improved profitability. However, a risk analysis reveals concerning aspects: the company carries a high level of debt, and cash flows do not need to cover its 2.57% dividend.

Trading/Investing Ideas Using Fundamental Analysis

Lastly, Table 2 presents some investing or trading ideas for you.

Thanks for reading!

Please remember to share your comments with me so that I can create a better version of this week's post in the next episode of the Sectoral ETFs Cycles News Letter.

Regards,

-Cenk

Financial Disclaimer: The information provided is intended solely for general informational purposes and does not constitute financial, investment, or legal advice. It is strongly advised to seek personalized guidance from qualified financial or legal professionals, considering your financial circumstances, investment objectives, and legal considerations. Given the inherent risks associated with financial markets and investment products, investment decisions should be made cautiously, considering your risk tolerance, financial goals, and a thorough evaluation of potential rewards and risks. Additionally, the accuracy and timeliness of the information are not guaranteed, and no warranties or representations are provided. Readers and users are urged to research and consult with experts before making financial or investment choices.