Top Performer: Energy ETF-XLE (+3.9%) Shines in Week Ending April 5, 2024

Communication Services ETF-XLC (+1.05%) follows XLE.

The week began with uncertainty stemming from robust economic data, which prompted concerns about potential Federal Reserve rate cuts. However, by week's end, optimism prevailed as the latest jobs report depicted a robust labor market characterized by better-than-expected job growth, low unemployment rates, and healthy wage gains. Despite ongoing concerns about the timing and extent of potential Fed rate adjustments, the markets closed positively. Nonetheless, this positivity couldn't wholly offset a slight weekly loss in SPX (-0.3% weekly loss).

On Thursday, oil prices surged upward due to escalating geopolitical tensions and looming supply risks. Brent futures for June surpassed $91 a barrel, gaining $1.30, while U.S. West Texas Intermediate (WTI) futures for May rose by $1.16. These prices marked the highest levels since October, driven by mounting geopolitical tensions and supply concerns. Consequently, this surge was pivotal in XLE's outperformance on April 5, 2024.

Weekly Returns

Only two sector ETFs emerged as winners in the week ending April 5, 2024: XLE, boasting a gain of 3.89%, and XLC, with a modest increase of 1.05%. Conversely, XLV (-3.05%), XLRE (-2.91%), XLY (-2.75%), and XLP (-2.66%) all suffered losses exceeding 2%, positioning them firmly among the week's losers.

Year-to-Date Performances

XLE leads year-to-date performances with an impressive 17.93% return. Following closely are XLC, XLF, and XLI, with returns of 13.88%, 10.97%, and 10.59%, respectively, outpacing SPY's (9.41%) performance.

Sectoral ETF Cycles

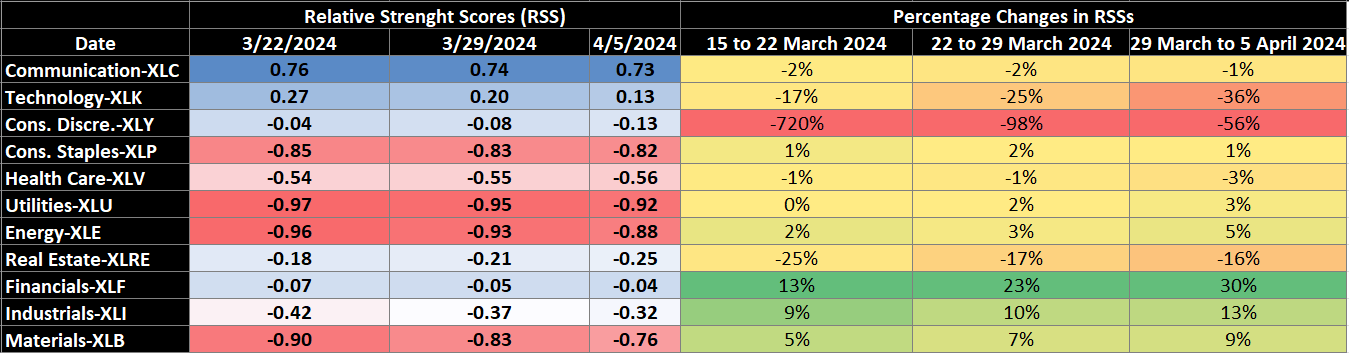

Examining Figure 3 alongside Table 1, while XLC and XLK have consistently maintained their Relative Strength Scores (RSSs) above zero, their power has dwindled with negative percentage changes in their RSSs over the past three weeks.

Conversely, XLF, XLI, XLB, and XLE have steadily gained strength over the same period while possibly indicating a rotation.

The hypothesis is further supported by the correlation values between XLF/XLI and XLF/XLB, which stand at 0.57 and 0.64, respectively, as shown in Table 2.

Communication Services Sector ETF (XLC)

Among XLC's top holdings, two notable winners emerged: META (8.60%) and NFLX (4.75%), while two significant losers were CHTR (-7.96%) and CMCSA (-4.95%).

Technology Sector ETF (XLK)

XLK's top holdings saw only three positives: MSFT (1.14%), AVGO (1.06%), and CRM (0.24%). The rest were in the red, with the most significant three losers being AMD (-5.58%), ACN (-3.93%), and ACN (-3.86%).

Consumer Discretionary Sector ETF (XLY)

Only one of XLY's top holdings emerged as a winner: AMZN, which boasted a 2.60% return. However, it was a particularly bleak week for six others, with losses exceeding 4%. The worst performers were HD (-6.71%), TSLA (-6.19%), and LOW (-6.05%).

Consumer Staples Sector ETF (XLP)

None of XLP's top holdings saw gains, with WMT being the least affected, experiencing only a 0.53% loss. Among the unluckiest were MO (-4.52%), PG (-3.79%), and PEP (-3.35%).

Health Care Sector ETF (XLV)

Nine of XLV's top holdings suffered significant losses, with UNH (-7.88%), ABBV (-6.64%), and AMGN (-5.05%) leading the downturn. The sole exception was LLY, which managed a modest gain of 0.80%.

Utilities Sector ETF (XLU)

Among XLU's top holdings, CEG emerged as the best performer with a 4.45% return. Conversely, SO (-2.55%), AEP (-2.50%), and SRE (-1.82%) experienced the most significant downturns.

Energy Sector ETF (XLE)

XLE reigned supreme in returns for the week ending April 5, 2024, with its top holdings posting positive returns. Leading the pack was MPC, the standout performer with an 8.75% return, followed closely by VLO (7.44%) and EOG (6.34%).

Real Estate Sector ETF (XLRE)

XLRE's top holdings saw no positive returns, with losses exceeding 4% for EQIX (-4.96%), CCI (-4.77%), PLD (-4.21%), and SPG (-4.05%).

Financials Sector ETF (XLF)

Only two positives emerged among XLF’s top holdings: SPGI (1.44%) and MMC (0.16%). The remaining eight reported negatives, with the largest losers being GS (-2.30%) and BAC (-2.14%).

Industrials Sector ETF (XLI)

GE has emerged as a standout winner with an impressive 11.57% return, followed by RTX (4.27%) and CAT (3.51%). Conversely, BA (-5.10%) and HON (-3.95%) were the worst performers.

Materials Sector ETF (XLB)

While XLB, as an ETF, showed a slight decline at -0.13%, three of its top holdings performed well: NEM (10.63%), FCX (5.21%), and DOW (3.04%). However, SHW experienced the most significant decline, with a loss of 4.46%.

Trading/Investing Ideas Using Fundamental Analysis

Lastly, Table 3 presents some investing or trading ideas for you.

Table 3. Trading Ideas. Note: The target prices are the fair values for stocks calculated by Simplywalstreet.st.

Thanks for reading!

Please remember to share your comments with me so that I can create a better version of this week's post in the next episode of the Sectoral ETFs Cycles News Letter.

Regards,

-Cenk

Financial Disclaimer: The information provided is intended solely for general informational purposes and does not constitute financial, investment, or legal advice. It is strongly advised to seek personalized guidance from qualified financial or legal professionals, considering your financial circumstances, investment objectives, and legal considerations. Given the inherent risks associated with financial markets and investment products, investment decisions should be made cautiously, considering your risk tolerance, financial goals, and a thorough evaluation of potential rewards and risks. Additionally, the accuracy and timeliness of the information are not guaranteed, and no warranties or representations are provided. Readers and users are urged to research and consult with experts before making financial or investment choices.