XLE (+3.44%) and XLU (+1.31%) Lead, While XLK (-0.73%) and XLY (-1.68%) Lag

CEG Soars 11.4%, Tesla and Apple Drop Nearly 5% | As of the week ending Friday, 03 January 2025 | Week-1.

Welcome to 2025’s first edition of the Sectoral ETFs' Cycles Newsletter, as of the week ending 03 January 2025. Sector performance across ETFs presented mixed results, with some sectors showing positive returns and others reflecting weakness. Leading the positive returns were the Energy (XLE), Utilities (XLU), Real Estate (XLRE), and Health Care (XLV) sectors, showing modest yet steady growth. However, specific sectors experienced notable declines, particularly Technology (XLK), Consumer Staples (XLP), Consumer Discretionary (XLY), and Materials (XLB), which saw more significant losses. This performance trend is essential as we look deeper into the Relative Strength Scores (RSS), offering a clearer view of sector momentum and potential market shifts.

Regarding momentum relative to the broader market, the Consumer Discretionary (XLY) sector displayed the most decisive upward momentum, supported by substantial weekly gains and an improvement in its RSS, indicating increasing strength. On the other hand, sectors such as Consumer Staples (XLP) and Health Care (XLV) showed signs of lagging momentum, with their RSS numbers decreasing significantly. Meanwhile, the Utilities (XLU) sector, which initially held a positive RSS, saw a sharp decline, underscoring the volatile nature of sectoral performance. Our correlation analysis further highlights the interrelationships between these sectors, with defensive sectors like XLP and XLV showing strong positive correlations. In contrast, cyclical sectors like Energy (XLE) and Materials (XLB) moved more in tandem. The cyclical behavior of these sectors and their relationship with broader market trends is vital in understanding where momentum is shifting in the market.

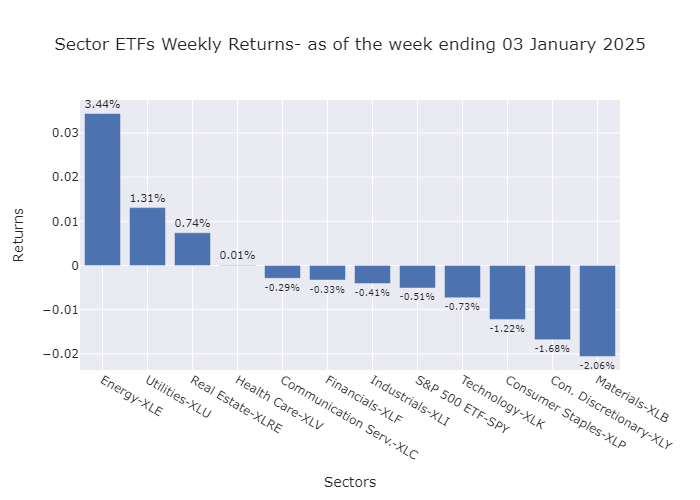

Weekly Returns

As of the week ending 03 January 2025, sector performance across ETFs displayed mixed results. Positive returns were led by XLE (+3.44%), XLU (+1.31%), XLRE (+0.74%), and XLV (+0.01%). However, losses were seen in several sectors, with XLC (-0.29%), XLF (-0.33%), and XLI (-0.41%) posting modest declines. More significant losses were recorded by XLK (-0.73%), XLP (-1.22%), XLY (-1.68%), and XLB (-2.06%), highlighting weakness in Technology, Consumer Staples, Consumer Discretionary, and Materials sectors.

Year-to-Date Performances

As of 03 January 2025, year-to-date returns highlight a generally positive start for most sectors. Leading the pack are XLE (+2.11%), XLU (+1.84%), XLK (+1.39%), XLC (+1.11%), and XLV (+1.01%). SPY (+1.00%) and XLI (+0.73%) also posted respectable gains. Modest advances were observed in XLY (+0.68%), XLF (+0.54%), and XLRE (+0.42%). On the downside, XLP (-0.36%) and XLB (-1.13%) faced declines, with Materials notably underperforming.

Sectoral ETF Cycles

As of 03 January 2025, the RSS scores and percentage changes reflect significant sectoral dynamics relative to SPY. XLY exhibited strong upward momentum, with an RSS rising from 0.78 to 1.00, supported by consecutive weekly gains of 21%, 16%, and 11%. XLC also trended positively, climbing from 0.71 to 0.78, with steady increases of 7%, 5%, and 4%. Conversely, XLP and XLV showed lagging momentum, with RSS for XLP declining from -0.44 to -0.50 (-7%, -6%, -6%) and XLV falling from -0.87 to -1.00 (-11%, -8%, -6%). Notably, XLU moved from a positive RSS of 0.07 to a negative -0.03, with steep drops of -42%, -76%, and -271% over the weeks. XLB continued to lag significantly, dropping from -0.77 to -1.00 (-15%, -14%, -13%), while XLI also weakened from -0.20 to -0.36 (-37%, -36%, -29%). Other sectors, such as XLE, XLRE, and XLF, displayed gradual declines, suggesting weakening momentum relative to SPY.

The correlations reveal important interrelationships among sector ETFs. XLC and XLK exhibit a moderate positive correlation (0.61), suggesting some trend alignment. Conversely, XLC is strongly negatively correlated with XLP (-0.89) and XLV (-0.88), indicating opposing movements. XLP shows high positive correlations with XLV (0.90) and XLU (0.92), hinting at defensive sector clustering. XLE demonstrates a strong positive correlation with XLB (0.71) and a moderate one with XLV (0.86), reflecting energy's alignment with materials and healthcare. Moderate positive correlations between XLF, XLI, and XLB (0.57–0.74) suggest potential strength in cyclical sectors. Negative correlations between tech-heavy XLK and defensive sectors like XLU (-0.71) underscore their divergence in market conditions.

Communication Services Sector ETF (XLC)

The Communication sector showed mixed performance for the week ending 03 January 2025. Positive returns were led by CHTR (+2.78%), VZ (+0.85%), and META (+0.80%). However, XLC declined by -0.29%, reflecting a broader weakness. Significant losses were recorded by GOOG (-0.47%), GOOGL (-0.50%), CMCSA (-0.69%), T (-0.83%), TMUS (-1.75%), and NFLX (-2.92%), highlighting notable underperformance among significant communication companies.

Technology Sector ETF (XLK)

The Technology sector had a challenging week ending 03 January 2025, with mixed performance across key stocks. NVDA was a standout, delivering a substantial gain of +5.44%, while AMD posted a modest rise of +0.14%. However, most major players faced declines, including CSCO (-0.58%), ACN (-0.65%), and XLK (-0.73%). More enormous losses were seen in ORCL (-1.56%), CRM (-1.64%), and MSFT (-1.67%). Significant underperformance came from ADBE (-3.56%), AVGO (-3.81%), and AAPL (-4.79%), highlighting weakness in prominent technology stocks.

Consumer Discretionary Sector ETF (XLY)

The Consumer Discretionary sector had a mixed week ending 03 January 2025, with modest gains in ORLY (+0.57%), MCD (+0.39%), SBUX (+0.36%), AMZN (+0.20%), and LOW (+0.06%). However, the sector as a whole, represented by XLY, declined by -1.68%, driven by notable losses in significant stocks. These included HD (-0.94%), TJX (-2.59%), BKNG (-2.65%), NKE (-4.07%), and TSLA (-4.92%), indicating significant underperformance among key consumer discretionary companies.

Consumer Staples Sector ETF (XLP)

The Consumer Staples sector experienced mixed performance for the week ending 03 January 2025, with MO (+1.45%) leading gains, followed by PM (+0.47%), TGT (+0.21%), and MDLZ (+0.21%). However, the sector overall, represented by XLP, declined by -1.22%, driven by losses among major players. Notable declines included WMT (-0.96%), KO (-1.12%), CL (-1.81%), PEP (-2.12%), COST (-2.46%), and PG (-2.60%), reflecting broad weakness in consumer staples companies.

Health Care Sector ETF (XLV)

The Health Care sector showed mixed results for the week ending 03 January 2025. Leading gains were ABBV (+1.80%), DHR (+1.62%), TMO (+1.13%), and UNH (+0.59%). The sector as a whole, represented by XLV, remained nearly flat at +0.01%. Losses were modest, with PFE (-0.11%), LLY (-0.15%), AMGN (-0.54%), MRK (-0.56%), JNJ (-0.59%), and ABT (-1.01%) slightly weighing on the overall performance.

Utilities Sector ETF (XLU)

The Utilities sector showed generally positive performance for the week ending 03 January 2025, with CEG leading the gains at +11.42%, followed by EXC (+1.66%) and D (+1.48%). PCG also posted a modest return of +1.42%, and the sector overall, represented by XLU, increased by +1.31%. On the downside, SRE (-0.11%), NEE (-0.17%), AEP (-0.50%), DUK (-0.52%), SO (-0.99%), and XEL (-2.13%) recorded losses, indicating some weakness in other utilities stocks.

Energy Sector ETF (XLE)

The Energy sector performed strongly for the week ending 03 January 2025, with MPC leading the gains at +5.21%, followed by EOG (+5.12%) and WMB (+4.93%). COP also posted a solid return of +4.30%, and VLO increased by +3.91%. The sector, represented by XLE, rose by +3.44%. Other notable gains were from PSX (+3.11%), CVX (+2.67%), and SLB (+2.09%). OKE gained 2.05%, while XOM saw a smaller increase of +1.30%, indicating broad strength across the energy stocks.

Real Estate Sector ETF (XLRE)

The Real Estate sector showed positive performance for the week ending 03 January 2025, with SPG leading the way at +2.36%, followed by DLR (+2.02%) and EQIX (+1.84%). O also posted a solid return of +1.68%, while PSA increased by +0.79%. The sector, represented by XLRE, rose by +0.74%. WELL gained +0.66%, and AMT added +0.38%. Smaller gains were seen in PLD (+0.37%) and CSGP (+0.04%), while CCI faced a decline of -0.63%, indicating some weakness among certain real estate stocks.

Financials Sector ETF (XLF)

The Financial sector showed mixed performance for the week ending 03 January 2025, with BAC leading the gains at +1.06%, followed by JPM (+0.87%) and GS (+0.69%). WFC also posted a small gain of +0.28%. However, the sector overall, represented by XLF, declined by -0.33%. Other notable losses came from SPGI (-0.44%), BRK-B (-0.65%), MS (-0.65%), MMC (-1.03%), V (-1.18%), and MA (-2.04%), indicating significant weakness in several financial stocks.

Industrials Sector ETF (XLI)

The Industrials sector showed mixed returns for the week ending 03 January 2025, with GE leading the gains at +1.11%, followed by UNP (+0.68%). However, the sector overall, represented by XLI, declined by -0.41%, with notable losses across several stocks. CAT fell by -0.29%, and RTX declined by -0.72%. Other significant losses included HON (-1.30%), DE (-1.45%), LMT (-1.46%), ADP (-1.52%), UPS (-1.84%), and BA (-5.99%), highlighting weakness in the sector during the week.

Materials Sector ETF (XLB)

The Materials sector showed negative performance for the week ending 03 January 2025, with NEM being the only stock with a positive return at +0.71%. The sector overall, represented by XLB, declined by -2.06%. Significant losses were seen across other stocks, with NUE falling by -1.09%, DOW by -1.57%, and SHW by -1.97%. Additionally, LIN declined by -2.24%, CTVA by -2.27%, APD by -2.44%, ECL by -2.45%, DD and FCX by -2.96%, reflecting broad weakness in the materials sector.

Trading/Investing Ideas Using Fundamental Analysis

Lastly, Table 3 presents some investing or trading ideas for you.

Your feedback matters!

Share your thoughts with me, and together, we can shape the next episode of the Sectoral ETFs Cycles Newsletter into something even more insightful and engaging. I look forward to hearing from you!

Warm regards,

-Cenk

Financial Disclaimer: The information provided is intended solely for general informational purposes and does not constitute financial, investment, or legal advice. It is strongly advised to seek personalized guidance from qualified financial or legal professionals, considering your financial circumstances, investment objectives, and legal considerations. Given the inherent risks associated with financial markets and investment products, investment decisions should be made cautiously, considering your risk tolerance, financial goals, and a thorough evaluation of potential rewards and risks. Additionally, the accuracy and timeliness of the information are not guaranteed, and no warranties or representations are provided. Readers and users are urged to research and consult with experts before making financial or investment choices.